The guidance requires employers to report separately the amount of emergency sick and family leave paid to employees under FFCRA on either 2021 Forms W-2, Box 14, or on a separate statement. The Internal Revenue Service issued guidance Notice 2021-53, to employers on the required reporting of qualified sick leave and family leave wages paid under the FFCRA. The ARPA's extended FFCRA paid leave provisions apply to leave taken between April 1, 2021, and September 30, 2021. Under the American Rescue Plan Act Of 2021 (ARPA), eligible employers may voluntarily pay Families First Coronavirus Response Act (FFCRA) leave for specified reasons related to the Coronavirus Disease 2019 (COVID-19). CA and New York allow exclusion from income for qualified moving expense reimbursements.

California and New York do not conform to the federal suspension of exclusion from income for qualified moving expense reimbursements under the 2017 federal tax law, HR.1, Pub. treaties (applies to the employees from the country that has treaty with the US). It is not excluded as income and is added to the taxpayers CA wages. CA taxpayers cannot deduct contributions to federal HSA from their California Wages. California does not conform to federal law regarding health savings accounts (HSAs). CA allows an exclusion from gross income for certain employer-provided benefits for a taxpayer's registered domestic partner and that partner's dependents. However, CA wages in Box 16 may differ from Box 1 federal wages for the following reasons: The amount in Box 16 state wages and Box 1 federal wages are usually the same. Why are the wages reported in Box 1 Federal Wages different than Box 16 State Wages? What do I do if I have self-employment in addition to wages paid by the State of California and I have FFCRA and/or EFMLA reported on my Form W-2?. What is the FFCRA and/or EFMLA reported in Box 14?. As an IHSS (In Home Support Service) employee, who do I contact to request a duplicate/corrected W-2 form?. I worked for multiple state agencies/campuses. I did a name change but I received a W-2 with my former name. Who should I contact if I have any further questions about my Form W-2?. Who should I contact for questions concerning federal or state income tax returns?. What should I do if I received a Form W-2 with an incorrect social security number or two or more Form W-2s with different social security numbers?. What are the maximum wages subject to California State Disability Insurance (CASDO)I). What other amounts are reported in Box 12?. Are Part-time/Seasonal/Temporary (PST) and/or Alternate Retirement Plan (ARP) contributions reported on the Form W-2?. Are Deferred Compensation or Tax Sheltered Annuity deductions reported on the Form W-2?. Are Fringe Benefits reported on the Form W-2?. What is the Dependent Care maximum contribution?. Why are the wages reported in Box 1 Federal Wages different than Box 16 State Wages?. Why are the wages reported in Box 1 different than Box 3 or 5?. Why is Retirement Plan “X’d” in Box 13?. What are the maximum wages subject to Medicare?. What are the maximum wages subject to Social Security?. Are Non-Industrial Disability (IDL) payments considered wages?.

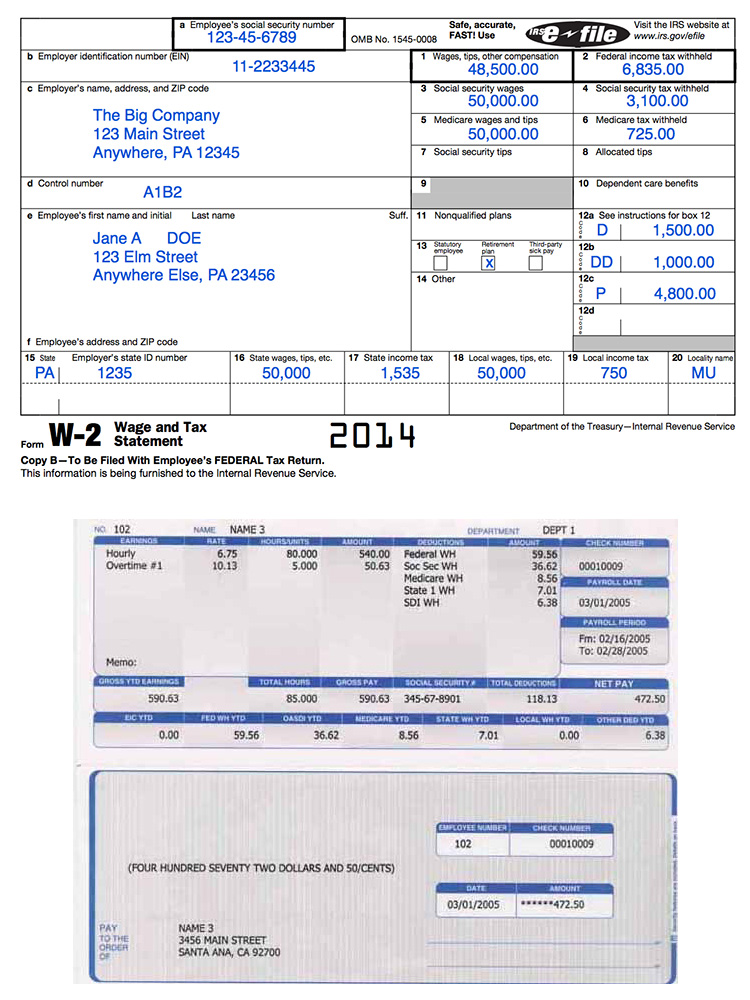

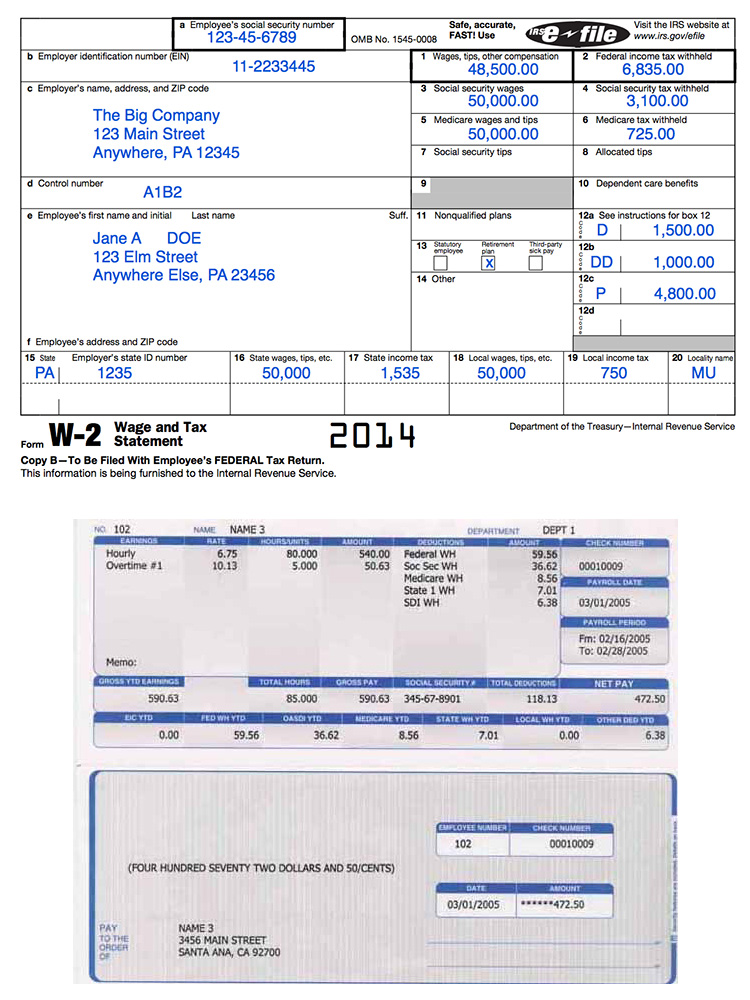

California and New York do not conform to the federal suspension of exclusion from income for qualified moving expense reimbursements under the 2017 federal tax law, HR.1, Pub. treaties (applies to the employees from the country that has treaty with the US). It is not excluded as income and is added to the taxpayers CA wages. CA taxpayers cannot deduct contributions to federal HSA from their California Wages. California does not conform to federal law regarding health savings accounts (HSAs). CA allows an exclusion from gross income for certain employer-provided benefits for a taxpayer's registered domestic partner and that partner's dependents. However, CA wages in Box 16 may differ from Box 1 federal wages for the following reasons: The amount in Box 16 state wages and Box 1 federal wages are usually the same. Why are the wages reported in Box 1 Federal Wages different than Box 16 State Wages? What do I do if I have self-employment in addition to wages paid by the State of California and I have FFCRA and/or EFMLA reported on my Form W-2?. What is the FFCRA and/or EFMLA reported in Box 14?. As an IHSS (In Home Support Service) employee, who do I contact to request a duplicate/corrected W-2 form?. I worked for multiple state agencies/campuses. I did a name change but I received a W-2 with my former name. Who should I contact if I have any further questions about my Form W-2?. Who should I contact for questions concerning federal or state income tax returns?. What should I do if I received a Form W-2 with an incorrect social security number or two or more Form W-2s with different social security numbers?. What are the maximum wages subject to California State Disability Insurance (CASDO)I). What other amounts are reported in Box 12?. Are Part-time/Seasonal/Temporary (PST) and/or Alternate Retirement Plan (ARP) contributions reported on the Form W-2?. Are Deferred Compensation or Tax Sheltered Annuity deductions reported on the Form W-2?. Are Fringe Benefits reported on the Form W-2?. What is the Dependent Care maximum contribution?. Why are the wages reported in Box 1 Federal Wages different than Box 16 State Wages?. Why are the wages reported in Box 1 different than Box 3 or 5?. Why is Retirement Plan “X’d” in Box 13?. What are the maximum wages subject to Medicare?. What are the maximum wages subject to Social Security?. Are Non-Industrial Disability (IDL) payments considered wages?.  Why is the year-to-date gross on my final earnings statement/direct deposit advice different than what is shown in Box 1?. What wages are reflected on the Form W-2?. What if I have not received my Form W-2 or my mailing address has changed?.

Why is the year-to-date gross on my final earnings statement/direct deposit advice different than what is shown in Box 1?. What wages are reflected on the Form W-2?. What if I have not received my Form W-2 or my mailing address has changed?.

I think my personal information has been compromised, whom do I contact?.Who should I contact if my Form W-2 was damaged, not sealed?.Frequently Asked Questions Regarding Form W-2

0 kommentar(er)

0 kommentar(er)